The Regions Premium Money Market Account is designed for clients who want to combine security, liquidity, and competitive returns within a solid, long-standing financial institution. Offered by Regions Bank, one of the largest regional banks in the U.S., this account allows customers to earn interest on their balances while maintaining easy access to their funds whenever needed.

It’s a great option for both individuals and small businesses seeking better returns than a traditional checking account without giving up flexibility for transactions. Here’s what makes it stand out.

Key Features

The Premium Money Market Account from Regions Bank operates as a hybrid between a checking and savings account. It earns daily interest on the balance based on market rates and deposit amounts, typically tied to the Federal Funds Rate. Interest is credited monthly and increases with higher balances, meaning the more you deposit, the greater your potential earnings.

One of its biggest advantages is instant liquidity. Customers can withdraw or transfer funds at any time without formal redemption requests. The account also supports checks, debit cards, and automatic transfers. It offers the convenience of a regular checking account with the added benefit of interest earnings.

Additionally, all deposits are insured by the FDIC (Federal Deposit Insurance Corporation) up to $250,000 per account holder, ensuring full protection of funds.

Main Benefits

The Regions Premium Money Market Account offers several benefits that make it appealing for those who want to keep their money accessible without letting it sit idle. Its tiered interest structure rewards higher balances with better rates compared to traditional savings accounts.

Flexibility is another plus. Unlike Certificates of Deposit (CDs) or fixed-term investments, this account provides unrestricted access to funds, ideal for maintaining an emergency fund or short-term savings.

Clients also enjoy personalized support, including access to financial advisors. They can help manage funds and recommend other investment opportunities within Regions Bank.

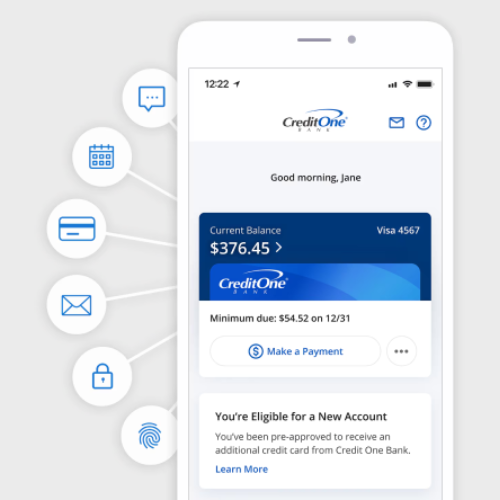

On top of that, the account includes full digital banking tools, such as a mobile app and online banking. For complete control over transactions, balance tracking, and integration with other Regions accounts.

Fees and Requirements

To open a Premium Money Market Account, Regions Bank requires an initial deposit, typically around $100, though this may vary by state or customer relationship.

The account has a monthly maintenance fee, with a minimum average balance, usually around $15,000. If the balance falls below that amount, a standard monthly fee applies. It is what states in the account agreement and on the Regions Bank website.

Regarding transactions, the account follows standard U.S. banking regulations that limit electronic transfers and automatic withdrawals to a certain number per month, although in-person withdrawals and ATM access are unlimited.

There are no early withdrawal penalties, giving customers full flexibility to use their funds whenever needed.

Who It’s Best For

The Regions Premium Money Market Account is ideal for customers seeking yield, safety, and liquidity, especially those with larger balances to invest. It’s a great middle ground between a checking account and an investment, offering above-average returns and easy fund access.

It’s also suitable for those who want to diversify their savings by keeping part of their assets in a low-risk, interest-bearing account. As a result, it appeals to conservative investors and families. Also for small businesses looking for a secure and flexible way to grow their capital.

Moreover, existing Regions Bank clients may find it particularly beneficial, as it can be seamlessly linked to other products like checking accounts, credit cards, and investment solutions.

How to Open an Account

Opening a Regions Premium Money Market Account is simple and available online, at a branch, or through the mobile app. Applicants need to provide basic personal information, valid identification (such as a Social Security Number), and funding details for the initial deposit.

Once opened, the account can be used immediately for transfers, check payments, or debit card transactions. Customers can also link it to a Regions checking account for quick fund transfers and better interest management.

Is It Worth It?

The Regions Premium Money Market Account is a strong choice for anyone looking to balance security, performance, and flexibility. It offers higher yields than traditional savings accounts, FDIC insurance protection, and full liquidity.

Although it requires a relatively high minimum balance to avoid fees, it remains a competitive option for clients with larger deposits, making it a reliable way to grow savings while keeping funds accessible.

you’ll be redirected to the financial institution’s site

All information in this and other US PIXIN articles is subject to change over time. Please check for updates directly with the institutions and companies mentioned. Approval is subject to the institution’s review.

REFERENCES:

Read more about banking in https://us.pixin.com.br/category/banking/