The Credit One Bank Bump-Up Jumbo Account is not a traditional checking account, but rather a high-yield deposit product offered by Credit One Bank. Specifically, it is a Bump-Up Jumbo Certificate of Deposit (CD) that combines competitive interest rates with the option to increase the yield once during the term of the contract.

This type of account is part of Credit One Bank’s digital savings product lineup, which also includes high-yield savings accounts and other jumbo CDs. These products are designed for investors with large amounts of capital who seek stable and secure returns with FDIC (Federal Deposit Insurance Corporation) protection.

Key Features

The Credit One Bank Bump-Up Jumbo Account is a certificate of deposit (CD) that requires a high minimum deposit (typically $100,000 or more) to access competitive interest rates.

Unlike traditional fixed-rate CDs, the Bump-Up Jumbo CD allows you to “bump up,” or increase, your interest rate once during the term if market rates rise. This means that if CD rates increase after you open your account, you can adjust your rate to the higher level and lock in better returns without closing your account or reinvesting.

This product attends investors who want safety and above-average yields compared to standard savings accounts, while keeping funds locked in for a fixed period with no immediate access until maturity, as is typical with CDs.

Main Advantages

One major advantage of the Bump-Up Jumbo CD is the ability to adjust your interest rate if the market offers better returns, a feature not available with traditional fixed-rate CDs.

In addition, Credit One Bank’s jumbo accounts tend to offer competitive APYs (annual percentage yields), often higher than standard savings accounts, helping maximize the growth of large balances over time.

Deposits are insured by the FDIC, meaning that up to applicable limits (generally $250,000 per depositor, per bank, per ownership category), your money is protected in case of bank failure.

Finally, there are no monthly maintenance fees as found with some checking accounts. You simply agree to the deposit amount and CD term when opening the account.

Fees and Costs

There are typically no direct maintenance fees with this type of account, and no monthly charges to keep the jumbo CD active.

The main cost related to CDs, including the Bump-Up Jumbo, is the early withdrawal penalty if you need to access your principal before maturity. These penalties usually involve forfeiting a portion of earned interest and vary depending on the selected term.

Another key requirement is the high minimum deposit (usually $100,000), which makes this product suitable only for investors with substantial capital reserves.

Who It’s Recommended For

The Bump-Up Jumbo Account is interesting for investors who already have a significant amount of cash available and want better returns than traditional savings accounts, without giving up the security of FDIC-insured deposits.

It is ideal for those willing to lock in funds for a fixed term in exchange for higher rates and the opportunity to capture interest increases over time, which benefits medium- to long-term investors.

On the other hand, if you do not meet the minimum deposit requirement or need daily liquidity, a lower-deposit savings account or another financial alternative may be more appropriate.

How to Apply

- Visit the official Credit One Bank website and go to the Deposits (Savings/CDs) section.

- Select the “Bump-Up Jumbo Certificate of Deposit” product and review the available terms, interest rates, and minimum requirements.

- Complete the online application with your personal details, address, and financial information required by the bank.

- Transfer the required minimum deposit (usually $100,000 or more) via ACH from another U.S. bank account.

- Review and submit your application before the CD’s start date.

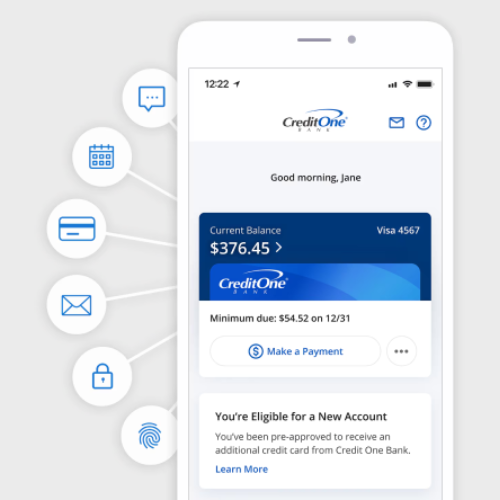

- After approval and funding, monitor your account through Credit One Bank’s online platform or deposits app.

Is It Worth It?

Opening a Credit One Bank Bump-Up Jumbo Account may be worthwhile if you have a large balance available to invest and want higher returns than traditional savings accounts, combined with FDIC protection and the flexibility of a one-time rate adjustment if interest rates rise.

For investors who fit this profile, the Bump-Up Jumbo CD can be an excellent low-risk way to grow money without hidden monthly fees or recurring costs.

you’ll be redirected to the financial institution’s site

All information in this and other US PIXIN articles is subject to change over time. Please check for updates directly with the institutions and companies mentioned. Approval is subject to the institution’s review.

REFERENCES:

https://www.creditonebank.com/

Read more about banking in https://us.pixin.com.br/category/banking/