Axos Bank CashBack Checking is an online checking account offered by Axos Bank in the United States, designed for people who want to earn cash back on debit card purchases and avoid monthly fees, while still having access to essential banking features such as fee-free ATM withdrawals in the U.S. and unlimited check writing. It is an attractive option for customers who frequently use their debit card for signature-based transactions and want to turn everyday spending into direct financial returns.

What Axos Bank CashBack Checking Is and How It Works

Axos Bank CashBack Checking works like a traditional checking account, but with an important difference: it pays cash back of up to 1.00% on qualifying purchases made with the debit card, as long as you maintain a required minimum average daily balance. This cash back is calculated monthly and deposited directly into your account, which can generate real financial returns on everyday expenses, with a cap of up to $2,000 per month in cash back.

To earn the maximum 1.00% cash back, the account holder must maintain a collected average daily balance of at least $1,500 in the account. If the balance falls below this threshold, the cash back rate is reduced to 0.50% for that month. Cash back applies to signature-based transactions, meaning purchases authorized with a signature or without entering a PIN.

In addition, the account offers unlimited reimbursement of domestic ATM fees within the United States and has no monthly maintenance fee or annual fee, helping you keep more money in your pocket with fewer direct costs.

Main Advantages

A clear advantage of CashBack Checking is the ability to earn cash back by using a debit card, something many traditional checking accounts do not offer. This return can be meaningful if you frequently use your debit card for qualifying purchases and are able to maintain the required minimum balance.

Another important advantage is the absence of monthly maintenance fees or annual fees, which sets it apart from many U.S. checking accounts that charge fees if certain conditions are not met.

Unlimited reimbursement of domestic ATM fees allows you to access cash at any ATM in the United States without worrying about extra charges, as the bank automatically refunds those fees.

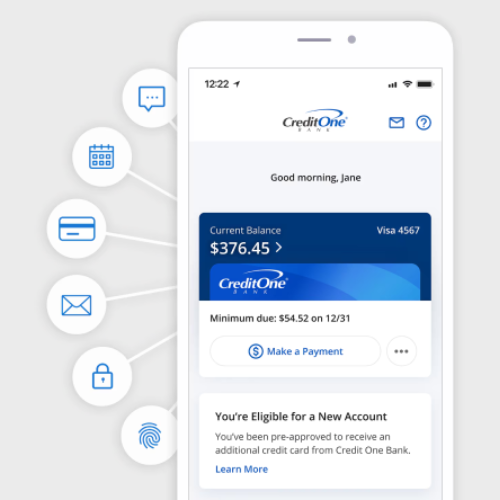

The account also includes unlimited check writing, which is increasingly rare today and useful for certain expenses, as well as access to digital banking services such as bill pay, transfers, and account alerts through the mobile app.

Costs and Fees

Axos Bank CashBack Checking does not charge a monthly maintenance fee or annual fee, making it competitive within the U.S. checking account market.

There are no direct costs for most basic services, and the reimbursement of domestic ATM fees eliminates a common expense for those who withdraw cash frequently.

It is important to note that cash back is only paid on qualifying signature-based transactions and if you meet the required balance level, and that certain purchases may not qualify for cash back depending on how the merchant categorizes the transaction.

There is no indication of negative interest rates or hidden fees, but as with any account, it is recommended to review the bank’s current account agreement and fee schedule before opening an account.

Who It Is Recommended For

CashBack Checking is recommended for customers who frequently use their debit card for everyday purchases and want to earn cash back rather than simply holding a balance with no return.

It is also a good option for those who value digital banks with no monthly fees, want to avoid domestic ATM charges, and are looking for a simple banking experience with minimal extra costs.

How to Apply

- Visit the official Axos Bank website and navigate to the CashBack Checking page.

- Click “Open an Account” or a similar option to begin the online checking account application.

- Complete the form with your personal information (name, address, SSN/ITIN, and contact details).

- Submit the required documentation for identification and verification (typically an ID, proof of address, and tax identification number).

- Set up an initial deposit (most reviews indicate that a small or symbolic minimum amount is required to activate the account).

- Confirm and complete the account opening, wait for approval, and receive your debit card to start using the account.

Is It Worth It?

Axos Bank CashBack Checking can be worth it for those looking for a digital checking account with no monthly fees that also offers cash back on debit card purchases, along with domestic ATM fee reimbursements in the U.S. and unlimited check writing, features that are not universal among digital bank accounts.

If you maintain a high enough average daily balance to earn the maximum cash back, this account can generate a meaningful return on everyday spending.

you’ll be redirected to the financial institution’s site

All information in this and other US PIXIN articles is subject to change over time. Please check for updates directly with the institutions and companies mentioned. Approval is subject to the institution’s review.

REFERENCES:

Read more about banking in https://us.pixin.com.br/category/banking/