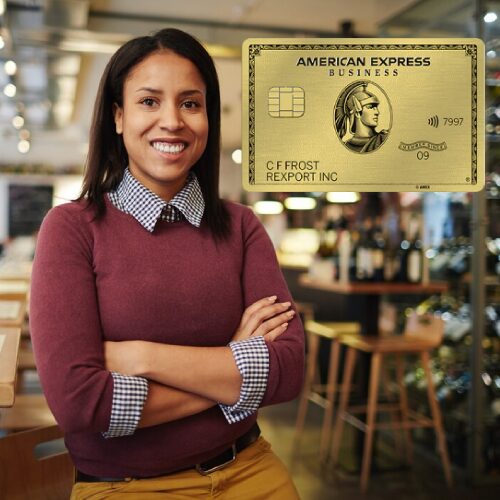

The American Express Business Gold Card is a powerful corporate card designed for small and mid-sized companies that want to earn Membership Rewards points on their most important business expenses.

It combines a flexible rewards strategy, statement credits that help offset operational costs, and protection benefits for travel and purchases—making it a strong option for business owners looking to optimize spending and maximize returns on everyday operations.

Key Features

With the Amex Business Gold, you earn 4× Membership Rewards® points in your company’s two most frequently used spending categories, selected from six eligible options. These categories include technology purchases, media, fuel, restaurants, transit, and cloud software.

For prepaid flights and hotels booked through the Amex Travel portal, the card earns 3× points per dollar. All other purchases earn 1× point per dollar.

The card also offers up to $395 per year in statement credits: up to $240 ($20 per month) for eligible purchases at FedEx, Grubhub, and office supply stores; and up to $155 for a Walmart+ membership paid with the card.

A recent update added cell phone protection: if you pay your phone bill with the Business Gold, you may receive up to $800 per claim (with a limit of two claims per year) in case of damage or theft.

Cardholders can choose from three metal designs, Gold, Rose Gold, and White Gold.

The card also supports “Pay Over Time,” allowing eligible purchases to be carried as a revolving balance.

Main Advantages

One of the card’s biggest advantages is the flexibility to earn more points. Because the 4× points automatically apply to the two categories your business spends the most on each billing cycle, you don’t have to preselect categories. The card adjusts to your spending behavior.

Also, this structure is especially useful for businesses with fluctuating expenses or those experiencing rapid growth.

The available statement credits are another meaningful benefit. If your company uses FedEx for shipping, Grubhub for team meals, or regularly buys office supplies, the $20 monthly credit can translate into real savings.

And if you already subscribe to Walmart+, paying the membership with this card brings a monthly credit that helps offset operational expenses.

Membership Rewards points can buy travel, statement credits, gift cards, or transferred to airline and hotel partners, giving business owners various ways to extract real value from their spending.

Costs and Fees

The Amex Business Gold charges an annual fee of $375. When the statement credits (FedEx/Grubhub/office supplies + Walmart+) are full, a significant portion of that cost can be offset. This makes the card more practical for companies with consistent operational spending.

Regarding financing charges under the “Pay Over Time” feature, Amex applies a variable APR ranging from 17.99% to 28.74% for eligible purchases you choose to revolve.

There is no foreign transaction fee, which can be an advantage for businesses that work with international vendors. However, it is always important to review the most up-to-date fee schedule as company policies can change.

Who Should Consider It

The Amex Business Gold is especially atractive for business owners with significant operational expenses in categories that align with the card’s main rewards structure.

If your company frequently spends on shipping (FedEx), meals, or office supplies, this card can deliver real savings through its monthly credits. It is also a strong choice for businesses that already pay for Walmart+ and want to maximize that cost.

Companies that value asset protection, especially for electronics, benefit from the cell phone insurance. And for businesses with frequent travel needs, the ability to accumulate and redeem Membership Rewards points for flights and hotels can help reduce travel expenses or support growth initiatives.

Is the Business Gold Card Worth It?

For many companies, the American Express Business Gold Card is a highly effective financial tool. It delivers a strong combination of earning power, operational credits, and practical insurance benefits, helping turn everyday business expenses into measurable returns.

If your company has regular spending in the covered categories, you may be able to offset much of the annual fee and still gain value through rewards. For growing businesses or those focused on financial efficiency, this card can pay for itself and offer meaningful advantages.

you’ll be redirected to the financial institution’s site

All information in this and other US PIXIN articles is subject to change over time. Please check for updates directly with the institutions and companies mentioned. Approval is subject to the institution’s review.

REFERENCES:

https://www.americanexpress.com/

Read more about credit cards in https://us.pixin.com.br/category/credit-cards/