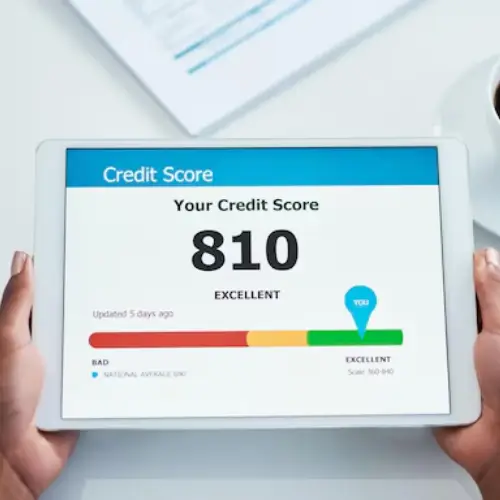

Many people strive for the perfect credit score, as it’s one of the main pillars of financial life. Your score determines how much interest you pay, whether you can rent an apartment, finance a car, or even qualify for certain jobs.

In the U.S., credit scores are typically measured using the FICO model, which ranges from 300 to 850 points. Hitting 850 is the dream of many consumers. But is it truly possible to achieve a perfect credit score? And what actually changes once you get there?

What Is a Credit Score?

A credit score is essentially a grade that credit bureaus, such as Equifax, Experian, and TransUnion, assign to each consumer based on their financial history.

The score reflects how risky it is for lenders to extend credit to that individual. The higher the score, the lower the risk. Meaning better chances of being approved for credit and receiving lower interest rates.

A score between 700 and 749 is considered good, while 750 to 799 is very good. The perfect score of 850 points represents a flawless financial record. However, only about 1% of Americans ever reach that number. That’s because maintaining a perfect balance among all the factors that influence your score requires time, discipline, and consistency.

Is It Really Possible to Get a Perfect Score?

Yes, it’s possible, but rare and not necessary. The credit scoring system was designed to evaluate risk, not as a competition. In practical terms, someone with a score of 820 is treated the same as someone with 850, both qualifying for the best credit rates and terms. In other words, a “perfect score” is more symbolic than functional.

Still, some people do achieve it. Typically, they have decades of credit history, no late payments, low credit utilization, and a diverse mix of credit types managed responsibly.

Factors That Influence a Credit Score

The FICO model calculates your score based on five key factors, each with a specific weight:

Payment History (35%)

This is the most important factor. Even one late payment can cause your score to drop significantly. Paying all bills on time is essential for maintaining a high score.

Credit Utilization (30%)

This measures how much of your total credit limit you’re using. The ideal utilization rate is below 30%, but those aiming for a perfect score should keep it between 1% and 7%. Using all your available credit can hurt your score. But using none at all can also lower it, since lenders want to see responsible credit activity.

Length of Credit History (15%)

The longer your accounts have been open, the better. This demonstrates stability and experience with credit. Closing old accounts can shorten your average account age, potentially lowering your score.

New Credit and Inquiries (10%)

Every time you apply for a new card or loan, a “hard inquiry” appears on your report. Having too many of these in a short period can make you appear financially stressed or risky.

Credit Mix (10%)

Lenders favor consumers who can manage various types of credit, such as credit cards, student loans, auto loans, and mortgages. A healthy mix shows you can handle different financial responsibilities.

Tips to Achieve (or Get Close to) a Perfect Credit Score

- Always pay on time.

Set up automatic payments to avoid missing due dates. Even one late payment can impact your score for months.

- Use credit sparingly.

Keep utilization below 10%. Paying part of your balance before the statement closes can help reduce the reported utilization rate.

- Keep old accounts open.

Even if you rarely use them, older accounts help strengthen your credit history.

- Avoid opening too many accounts too quickly.

Each new application triggers a credit inquiry, which may lower your score slightly for a short period.

- Monitor your credit report.

Check regularly for errors in reports from major credit bureaus. Even a small mistake can negatively affect your score.

- Diversify your credit types.

Relying only on credit cards can limit your score potential. If appropriate for your situation, consider a small personal loan or installment loan to balance your credit mix.

Does Having Perfect Credit Score Really Make a Difference?

In practice, the difference between a 830 and an 850 score is minimal. Both usually qualify for the same low interest rates and premium credit offers.

The real advantage lies in financial confidence and prestige. Those at the top of the scale are seen as low-risk, “premium” borrowers and may find it easier to negotiate favorable terms.

However, the main goal should be consistency, not perfection. A strong credit score is built through healthy habits, financial discipline, and stability over time. Instead of chasing a perfect number, focus on maintaining balance among spending, credit management, and long-term financial goals.

you’ll be redirected to the financial institution’s site

All information in this and other US PIXIN articles is subject to change over time. Please check for updates directly with the institutions and companies mentioned. Approval is subject to the institution’s review.

REFERENCES:

Read more about finances in https://us.pixin.com.br/category/blog/