The U.S. Bank Elite Money Market Account is an attractive alternative for those seeking higher returns than a traditional savings account while still valuing easy access to their funds.

With a low opening balance requirement, solid banking benefits, and a tiered interest structure that rewards larger deposits, this account offers an appealing mix of liquidity and growth. Here’s how to unlock its best terms and take advantage of its benefits.

Key Features

This account requires just a $100 opening deposit, making it accessible for most customers. Its main differentiator is the tiered APY structure: balances under $25,000 earn a symbolic rate of about 0.01% APY.

Once that threshold is crossed, however, the rate jumps significantly, reaching around 4.25% to 4.50% APY in certain promotions and regions, making it one of the strongest yields among traditional banks.

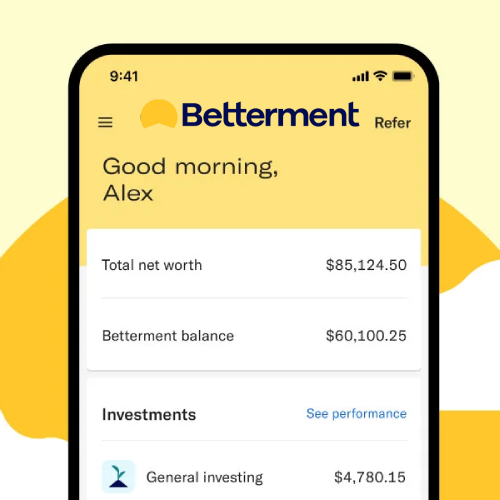

Funds remain highly accessible: the account provides checks, an ATM/debit card, transfers, and access to U.S. Bank’s award-winning digital tools, including its highly rated mobile app and online banking.

Additionally, deposits are FDIC-insured up to the standard $250,000 per depositor, ensuring peace of mind for those investing significant sums.

Main Advantages

For customers who can maintain the balance needed to qualify for the top-tier yield, the account provides a rare advantage: full liquidity combined with strong returns. The ability to write checks and use an ATM card makes everyday access simple and practical.

The nationwide branch and ATM network also appeals to those who prefer in-person service. On top of that, FDIC insurance and modern digital features enhance both convenience and security.

Rates and Fees

The U.S. Bank Elite Money Market Account has a $10 monthly maintenance fee, which can be waived by keeping a daily balance of at least $10,000 or linking the account to a Smartly Checking with enrollment in the Smart Rewards program.

Other possible costs include inactivity fees (around $5), out-of-network ATM withdrawals, and service charges for items like cashier’s checks or wire transfers.

Who Should Consider It?

The U.S. Bank Elite Money Market Account is best for customers with substantial savings who want higher earnings than a savings account while maintaining full liquidity. It’s also appealing to those who value the security and flexibility of a traditional bank with a wide branch presence, combined with modern digital convenience.

If you typically keep a high balance (above or near $25,000), this account can be a competitive choice, provided you’re comfortable maintaining that level to access the best APY.

How to Open a U.S. Bank Elite Money Market Account

Opening the account is straightforward. You can start online through the U.S. Bank website by providing basic personal information, with a minimum deposit of just $100.

Alternatively, you can open the account in person at a branch for personalized service and support. Once opened, you can manage your money through the mobile app, online banking, or ATM withdrawals.

Is the U.S. Bank Elite Money Market Worth It?

For those with significant balances who want a safe and liquid way to earn more on their money, the U.S. Bank Elite Money Market is a strong fit. The APY of up to 4.25%–4.50%, among the best offered by traditional banks, makes it worthwhile for savers willing to maintain the required balance.

In summary, the Elite Money Market is a solid choice for customers who prioritize security, flexibility, and attractive yields within the traditional banking system, so long as they are comfortable keeping the necessary funds active to secure the best rates.

All information in this and other US PIXIN articles is subject to change over time. Please check for updates directly with the institutions and companies mentioned. Approval is subject to the institution’s review.

REFERENCES:

Read more about banking in https://us.pixin.com.br/category/banking/